Financial Wellness at Workplace (The Guardian: 14/02/2017)

According to PricewaterhouseCoopers’ 2016 Employee Financial Wellness Survey incorporating the views of 1.600 full-time employed adults in the U.S.:

• 45% of employees identify financial matters as the most stressful issue they face;

• 40% have difficulty meeting their household expenses each month;

• 24% have withdrawn money from their retirement plans to pay for unrelated expenses.

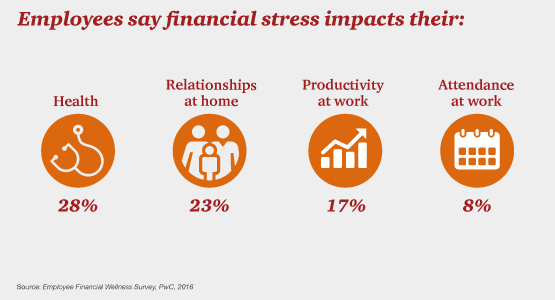

The report further states that financial stress is up in 2016 with 52% of employees stressed about their finances. With 45% employees saying that financial matters cause them the most stress in their lives – nearly as may as those whose top stress is their job, health or relationships combined – financial wellness is emerging as a key factor in employees’ overall well-being. It is important for employers to show that they care about employees’ financial well-being as this will positively impact retention, recruitment and productivity.

As the workforce becomes younger, its financial needs are changing. Employees face money issues that range from debts to saving for a house or assisting aging parents and extended families. Financial wellness has a tangible impact on business. People who are stressed about money are prone to absence and spend more time dealing with personal financial issues. This, in turn, leads to a lag in productivity. According to the survey, 20 percent of employees say their financial issues have been a distraction while at work, where each week 37% spend three or more hours dealing with their personal finances.

Benefits of educating employees on financial fitness

Financial education provides a twofold benefit: It helps employees find personal improvement in their financial health, and it helps increase employee productivity by lowering their stress.

Employers have a special opportunity to help educate workers and assist them in becoming more financially savvy. It may seem scary to use company time to offer education that does not appear to have immediate results, but many studies have shown that there is a significant return on investment available for employers who undertake this type of effort.

1. Better Employee Health

Traditionally, we consider wellness to be covered by physical activities and better eating habits, but wellness is closely related to financial health, too. Extreme stress leads to worsened health, and therefore, less time spent in the office being productive. Extreme stress can cause employees to pick up unhealthy habits, too and these unhealthy habits can exacerbate an environment of stress. By incorporating financial education for your employees. You can increase your workers’ health and productivity while lowering your health insurance premiums.

2. Fewer distractions and Higher Productivity

Workers who struggle to pay bills and balance their finances outside of work often use up time in the office trying to sort out these personal matters. According to the Pricewaterhouse Coopers study, one in five employees reports that personal finances have caused a notable amount of distraction while at work.

Even more concerning, 37% of all employees spend three full hours or more at work thinking about or handling their finances. Over a year, this adds up to 156 hours of lost productivity. When translated to workdays, an employer is losing 20 days per year to financial stress.

Multiply that by the size of the workforce, and productivity as a result of financial stress begins to look like a very serious issue. And these numbers do not include money issues caused by financial emergencies, or lack of sleep from financial stress that can keep employees out of the office altogether.

3. Better commitment and improved morale

If employees feel that their employer has a vested interest in helping them succeed in building and maintaining their current finances and financial future, that sense of security helps improve the bond between your business and employee. Financial freedom also reduces the number of loans and advances you have to handle.

If equipped with better financial education, employees can stay on top of their financial responsibilities, experience fewer emergencies, and remain better focused while at work.

Investing in financial wellness boosts the overall well-being of employees, increasing their health, productivity and engagement. When employees feel their employers care about their health and well-being, they are 38 percent more engaged.

Reply back to bhakti@impactafya.com or call +255 754 694 643 with your feedback. We welcome your suggestions for corporate wellness issues you’d like to see covered in our future columns.

Bhakti Shah, MPH is the Founder and Managing Director of ImpactAfya Ltd, collaborating with Workplace Options and Mayo Clinic, USA to provide Corporate Wellness and EAP Solutions in East Africa. Bhakti is also the Past President of the American Chamber of Commerce in Tanzania and the Chair for Health Concerns for Rotary District 9211.

Website: www.imapctafya.com | Facebook, Instagram & Twitter: @impactafya